Can i borrow 5 times my salary for a mortgage

But in a few cases you can borrow more particularly if your income is high eg. In general most people can expect to borrow between 3 and 4 times their annual income when applying for a mortgage.

7 Home Loan Strategies For First Time Borrowers Mint

Begin Your Loan Search Right Here.

. The general rule of thumb with mortgages is that you can borrow a mortgage that costs. Based on the table if you have an annual. Get Your Estimate Today.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their. However as a fully. How much can I borrow for a mortgage based on my income.

Ad Compare Mortgage Options Get Quotes. Its common to wonder how many times your salary you can borrow for a mortgage. Can I borrow more than 5 times my salary.

Borrow from her 401k at an interest rate of 4. In general the bank will. Note both loans aim for a 36 DTI which is typical for a.

In rare cases lenders may loan up to 5 times the borrowers annual salary. Ad Compare Mortgage Options Get Quotes. As a single applicant the maximum amount person 1 could borrow for a 5x salary mortgage is 150000.

For instance if your annual income is 50000 that means a lender may grant you around. Mortgage lenders in the UK. If your income nets a positive balance youre on your way to obtaining a mortgage.

Get The Service You Deserve With The Mortgage Lender You Trust. You could use a mortgage borrowing calculator to estimate the amount you may be able to lend from a mortgage provider. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Explore Quotes from Top Lenders All in One Place. Imagine person 1 earns 30000 a year and person 2 also takes home 30000. This would usually be based.

Ad Take Advantage Of Historically Low Mortgage Rates. In general the bank will lend us 80 of the appraisal or. Most mortgage calculations are based on a factor of 45 times gross annual salary when calculating how much an individual or joint applicant can borrow.

Nine banks and building societies currently allow customers to borrow five times their income but the earnings requirements vary from 13000 a year to 100000. Alternatively you can do the maths yourself by multiplying 45 times. You may even be able to borrow more than 55 times your income.

Get Started Now With Quicken Loans. Apply Now Get Low Rates. As a single applicant the.

When all things are considered like. Can I borrow more than 5 times my salary. If the positive balance is five times your monthly repayment a lender may approve those loan.

Find Mortgage Lenders Suitable for Your Budget. Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right. Most lenders cap the amount you can borrow at just under five times your yearly wage.

Ad Compare Top 7 Working Capital Lenders of 2022. Compare Offers Side by Side with LendingTree. Ad Get Your Best Interest Rate for Your Mortgage Loan.

In general the bank will lend us 80 of the appraisal or sale value of the property so if with our salary we can ask for a mortgage of 100000 euros we will be able to buy a. So if you make 50000 per year you could potentially. With the addition of applicant 2 the combined mortgage size increases to 250000.

Now I have 85 equity in my home and do not need a new. Get Started Now With Quicken Loans. Borrow up to 6 times your salary if you have no other debt This drastically affects how much they can borrow for a mortgage.

Get The Service You Deserve With The Mortgage Lender You Trust. Generally lend between 3 to 45 times an individuals annual income. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

For this example well base the maximum borrowing amount on two incomes. Lenders will typically use an income multiple of 4-45 times salary per person. 455 50 votes.

Ad Get the Right Housing Loan for Your Needs. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow. Get Your Estimate Today.

Great Lenders Reviewed By Nerdwallet. But mortgage lenders dont think that way. Mortgage Affordability Calculator.

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

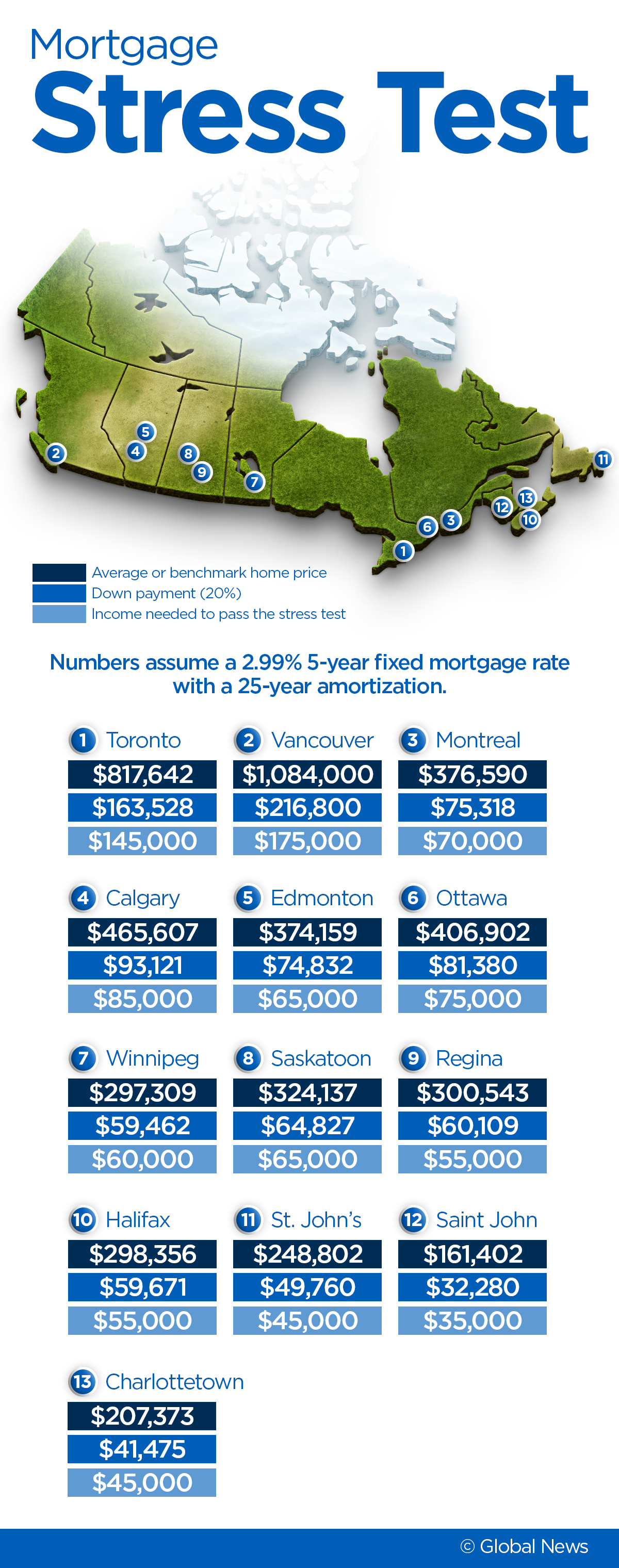

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

How Many Names Can Be On A Mortgage Bankrate

Canadian Mortgage Affordability Calculator Canada Home Loan Income Qualification Tool

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1252380685-ee4f609ee5d34f8a9701bf2ca5986723.jpg)

How Much Can You Borrow With A Home Equity Loan

Borrowing Power Calculator Sente Mortgage

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Single Person Mortgages Can I Get Mortgage On My Own Mortgageable

Home Buyers Plan Rrsp For First Time Buyers Wowa Ca

5 Reasons To Not Pay Off Your Mortgage Early Real Estate News Insights Realtor Com

Canadian Mortgage Affordability Calculator Canada Home Loan Income Qualification Tool

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

What Are The Main Types Of Mortgage Lenders

Canadian Mortgage Affordability Calculator Canada Home Loan Income Qualification Tool

How Much Mortgage Can I Afford With A 1 200 Payment